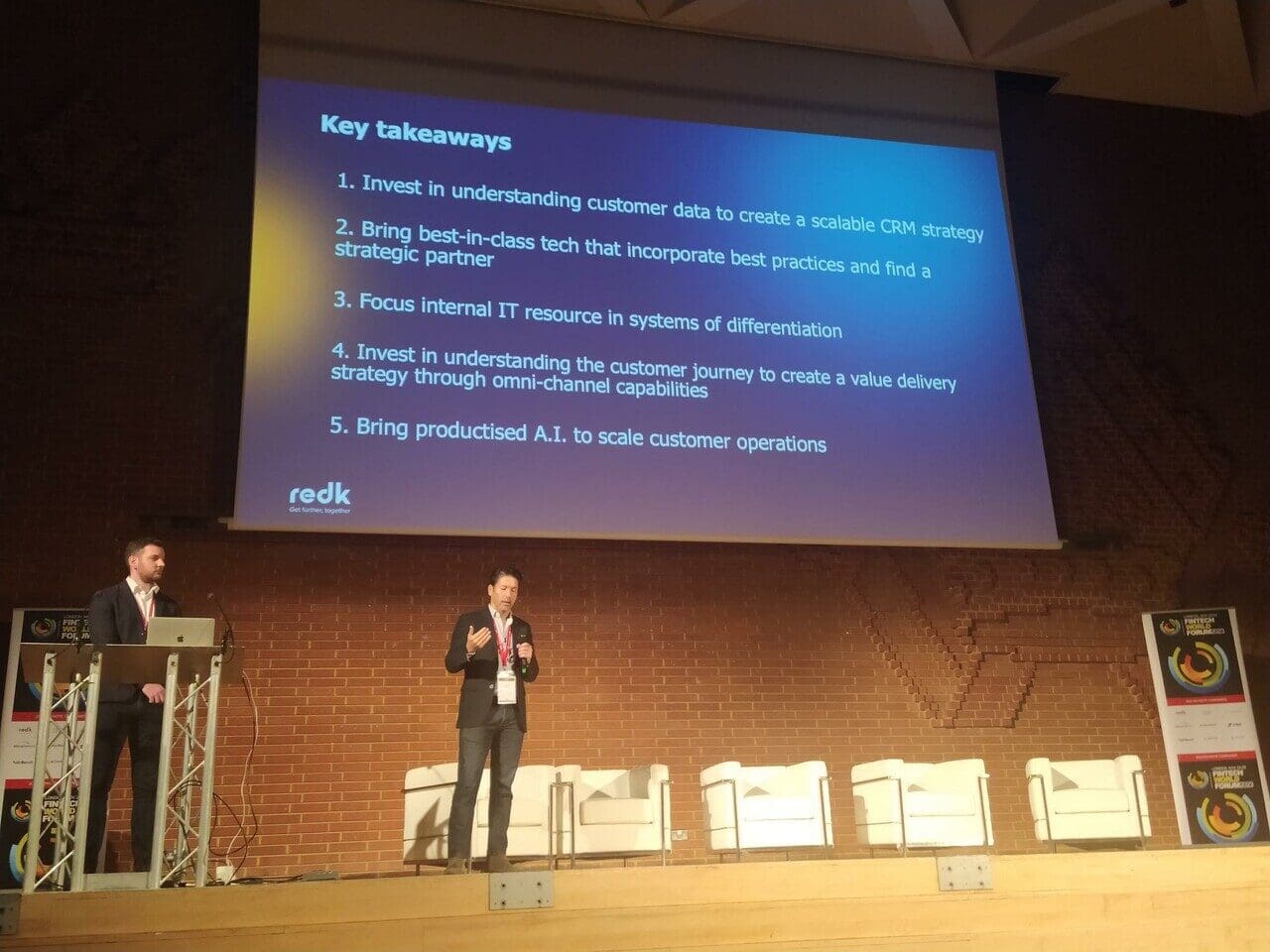

The redk team led a keynote presentation at the FinTech World Forum last month. Our CMO and CRM/CX Strategist, Hideki Hashimura, and UK Commercial Lead, Tom Jeanes, shared groundbreaking insights on using AI for scalable customer service in FinTech.

These insights shed light on AI’s role in enhancing the customer experience and addressed the broader scalability challenges in the rapidly evolving FinTech landscape. In this blog post, we dive into the key insights from our presentation and how you can use them to scale your customer service department in the FinTech sphere.

Understanding and Leveraging Customer Data

A central theme from the forum was the importance of customer data in FinTech. In a digital-first world, effectively harnessing vast amounts of data is vital for growth and customer engagement. It is crucial to comprehend customer interactions across various channels, whether it’s through human agents or automated systems.

FinTech companies must aim for hyper-personalisation while navigating the complexities of regulatory compliance. The challenge intensifies with the dynamic nature of these regulations and evolving customer expectations.

Product Focus vs. Customer Experience

Our presentation highlighted the need for FinTech firms to balance their focus between product development and customer experience. Often, companies prioritise product-centric approaches at the expense of leveraging data for customer engagement. This can lead to fragmented customer service systems and a failure to deliver value effectively.

Understanding the diverse customer journey is imperative to delivering excellent customer experiences.

Every customer segment, from premium to local customers, has a unique path with the company. Designing distinct journeys for different customer types can significantly enhance the customer experience, catering to each segment’s specific needs and expectations.

Furthermore, implementing omni-channel capabilities is essential to provide a seamless customer experience. This approach ensures that customers receive consistent and efficient service across all channels. The backbone of this strategy is a robust data layer that connects customer data with product data, enabling a unified and informed customer service approach.

The Role of Technology in Customer Service

The keynote highlighted the necessity for FinTech companies to be agile in their technology and customer service approach. FinTech companies are often at the forefront of technological innovation, but effectively leveraging this technology is another matter entirely.

The emphasis should be on choosing and implementing technology that aligns with core business capabilities, particularly advanced CRM systems.

These systems should be implemented technically and strategised to scale with the business, offering a comprehensive view of the customer for personalised marketing, upselling, cross-selling and reduced churn.

The rapidly changing landscape in customer expectations and regulations requires FinTech companies to be adaptable and flexible. This adaptability extends beyond products and services to the underlying technology and organisational structure.

Systems of Record, Innovation, and Differentiation

To tackle scalability effectively, FinTechs need to concentrate on three core systems: systems of record (like CRM and finance systems), systems of innovation (automation capabilities), and systems of differentiation (unique digital capabilities). A common pitfall for FinTechs is an excessive focus on product, leading to a proliferation of disjointed customer service and CRM systems. These fragmented systems fail to structure data effectively, impeding value delivery to the end customer.

The Integration of AI in FinTech

AI’s integration into CRM systems is a prime example of innovation. Productised AI, utilised in platforms like Salesforce or Ada, leverages machine learning to enhance customer service efficiency. This means that companies can leverage existing AI technologies tailored for specific purposes instead of building expensive AI solutions from scratch. These can include conversational AI for customer interactions, predictive analytics for personalised marketing, and automated systems for resolving customer service tickets.

AI’s effectiveness largely depends on the quality and structure of the underlying data, emphasising the importance of a well-organised data management system.

However, the challenge for FinTechs is strategically integrating AI into their customer experience and CRM strategies. Many FinTechs have centred their CRM systems around their products, leading to scalability issues. Best CRM and customer experience practices are often overlooked in favour of product development, resulting in suboptimal customer engagement systems.

We explore the role of AI in customer service in more detail in our report: How AI is Reshaping Customer Service Operations.

Moving Forward with AI

Embracing AI as a strategic component for business growth is vital. Despite its recognised importance, many companies are hesitant to fully realise AI’s potential in enhancing customer engagement and lifecycle management. The solution lies in a balanced approach where FinTechs focus on product development while applying best practices to the customer experience.

The insights from the Fintech World Forum make it clear that scaling customer service in FinTech with AI is a multifaceted challenge.

It involves understanding and leveraging customer data, balancing product development with customer experience, and strategically integrating AI. FinTech companies need to navigate the complexities of rapid market changes and regulatory compliance, ensuring that their approach to customer service is as innovative and dynamic as their technology.

To delve deeper into these strategies and discover how to maximise your Sales Cloud’s potential to impact your sales performance, we invite you to download our latest whitepaper. Explore comprehensive insights and practical tips tailored to enhance your organisation’s scalability and efficiency. Download now: Maximise Your Sales Cloud Potential.